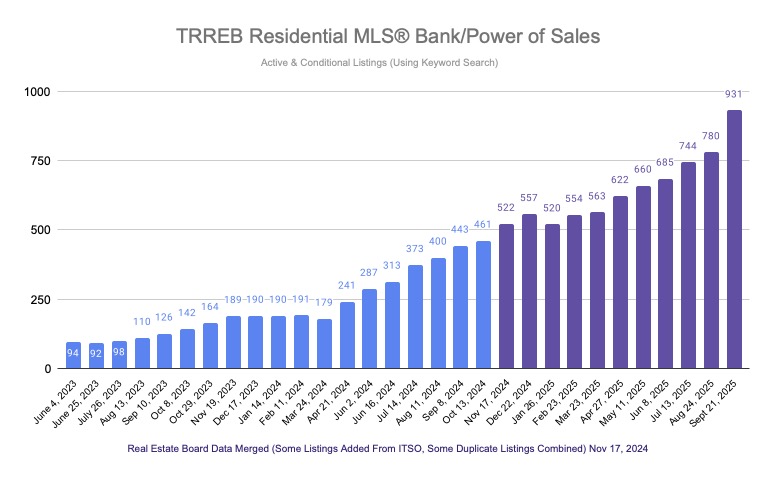

HOLD ON TO YOUR SEATS! Power of Sales Up Again in September

🚨 TREBB Residential MLS Bank/Power of Sales Statistics:

It's going to get a lot worse before it gets better!

📊 Data source: JonFlynnREstats on X.com (Twitter)

The Ontario real estate market is experiencing an unprecedented surge in Power of Sales cases, and the numbers are nothing short of alarming. With a staggering 113% increase from September 2024 and an astronomical 639% jump from September 2023, property owners across the province are facing financial distress at levels we haven't seen in years.

What does this mean for landlords? This dramatic increase in foreclosures signals a broader economic pressure that's affecting property owners' ability to maintain their mortgages and carry their properties. When owners can't make their payments, the ripple effects reach tenants, and ultimately, this instability can cascade through the entire rental market.

Why This Should Concern Every Ontario Landlord

In an increasingly unstable market, the tenants you choose today could be the difference between maintaining your property investment and facing your own financial difficulties. Poor tenant choices don't just mean missed rent payments – they can trigger a cascade of problems:

- Missed Mortgage Payments: Unpaid rent directly impacts your ability to service your mortgage

- Legal Costs: Eviction proceedings, LTB hearings, and legal fees can cost thousands

- Property Damage: Problem tenants often leave significant damage that eats into your equity

- Lost Rental Income: Months of vacancy while dealing with problematic tenants

- Stress and Time: The emotional and time cost of dealing with tenant disputes

With the current market volatility, there's never been a more critical time to ensure every tenant you accept has been thoroughly vetted. The cost of a comprehensive screening is minimal compared to the potential financial devastation of choosing the wrong tenant.

Protect Your Investment with Professional Tenant Screening

Don't let the next Power of Sales statistic be your property. For just $79, 360Tenant provides comprehensive screening that helps you avoid the tenants who could put your investment at risk.

Your Complete $79 Screening Package Includes:

- Credit Report & Financial Analysis

- Recorded Phone Calls to References & Employers

- Document Verification (Pay Stubs, Employment Letters)

- Social Media & Public Records Search

- Landlord Tenant Board Search

- Professional Assessment & Recommendation

Know exactly who you're renting to before it's too late.

Get Started - Protect Your Property for $79The Reality of Today's Rental Market

With economic pressures mounting and Power of Sales cases reaching these unprecedented levels, tenant financial stability is more questionable than ever. Many prospective tenants may be:

- Facing their own financial difficulties

- Recently displaced from foreclosed properties

- Dealing with job instability or reduced income

- Carrying higher debt loads due to economic pressures

- More likely to provide false information to secure housing

This environment makes professional tenant screening not just helpful – it's essential for survival in the rental property business.

⚠️ Don't Become a Statistic

The same economic pressures driving these Power of Sales increases are affecting potential tenants. Protect your property investment with thorough screening that verifies income, checks references, and identifies red flags before they become your problem.

The data is clear: financial distress is spreading across Ontario's real estate market. As a landlord, your best defense against becoming part of these troubling statistics is making informed decisions about who you allow to occupy your property.

Don't wait until you're facing your own financial difficulties. Invest in proper tenant screening today – because in this market, you simply can't afford to get it wrong.